|

| Download |

As is the case for so many families, this time of year money is tight. The typical money pits of Thanksgiving and Christmas bookend two additional spending occasions for our family: Sinterklaas (Dutch Christmas) and our son's birthday. If we aren't very careful, December can wreck havoc on our budget.

Over the past few years, we tried a few different savings plans. I use PNC's Virtual Wallet to set aside money throughout the year for things like our son's preschool tuition and bills that are not paid monthly. I have had a harder time setting aside money that was not for a specific purpose. For some reason, I do better if I know the dollar amount I am trying to reach.

Two years ago, we tried saving $10 a week. It worked for awhile, but we dipped into that stash over the year. About a year ago, I read about the idea of the 52 Week Money Challenge. It's been credited to both Montina Portis and Kassondra Perry-Moreland.

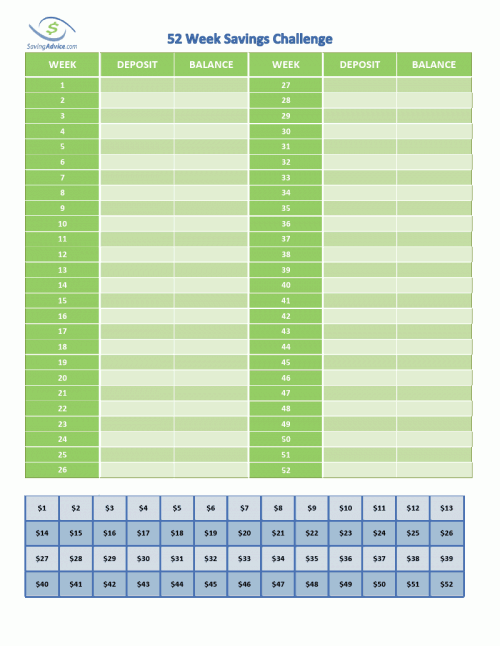

I printed it out and referred to it as I set my budget for 2013. As you can from the chart, you save a dollar for each week of the year--$1 in week one, $2, in week two, etc.--until you reach a deposit of $52 in week fifty-two, for a total of $1,378 for the year. Pretty cool, eh?

Over the course of the year, I've seen Facebook posts about the challenge as friends as checked in to see who was sticking with it. That's when I started to hear about variations. I like the alternative that Saving Advice offers, which lists all the weeks at the bottom of the page, and you have flexibility to chose the amount you save each week, so long as you cross off all the week numbers by the end of the year.

|

| Please do NOT pin this image from our site. Please pin from the source. |

For our family--and apparently many, many others--was to start saving the highest amount ($52) and saving one dollar less as the year went on so that by the time we get to December, aka budget-bustember, we only have very small amounts to contribute each week.

This worked very well for us. Even when we had to dip into our savings a couple of times, it wasn't too painful to catch up. In fact, I finished a little early because I wanted to use my savings to take care advantage of Amazon's Black Friday shopping. (Living with a brain injury means I need to avoid the malls most of the year, and especially during the sensory overloaded Holiday season. I aim to have all of my shopping done by Thankgiving and thank God for the convenience online shopping.) I will soon be the proud owner of a new Nikon 7100 DSLR Camera. I have been a very good girl!

I loved that I could make such a big purchase without using my credit card, so now that I'm starting to work on my 2014 budget (how is that possibly?!), I tweaked the challenge so we'd be officially done by Black Friday. And, with a little extra effort, plus one additional deposit on Tax Day, you'll end up with $1500!

|

| Download |

Linked to:

Dear Creatives * The Dedicated House * DYI Dreamer * Feeding Big * Fluster Buster * Frugality Gal * Grace Langdon * Implausibly Beautiful * Krafty Cards Etc. * Life After Laundry * Memories By The Mile * My Life of Travels and Adventures * Naptime Creations * Pursuit of a Functional Home * Sowdering about in Seattle * Tatertots & Jello * We are THAT Family * Will Cook for Smiles

Print this post

Congrats on your new camera and what a brilliant way to save for next year. Thank you for linking to the In and Out of the Kitchen Link Party. I look forward to seeing you next week.

ReplyDeleteI love this way of saving. I've seen it before but I think I will actually do it this year!

ReplyDeleteThanks for sharing.

xoxo

This is an excellent idea! My husband and I will definitely be doing something like this, especially since we have a new baby.

ReplyDeleteTenns @ New Mama Diaries

Congrats on your new addition. This would be a great way to have a baby fund. So many things to buy for a baby...and toddler...and child!

DeleteI started this already. Didn't wait until the new year. I started at the first of December. I know when I wait to do something, I will probably forget it. I also started with the highest amount. Want to get that out of the way first. I'm in 40s now. Crossing my fingers that I can keep this up....

ReplyDeleteSharon

Make It Or Fix It Yourself

Way to get started. I put the savings into my monthly budget so I don't forget. I did have to dip into it a few times, but I was able to catch up, too.

DeleteThanks for sharing at the Krafty Inspiration Thursday Link Party, you have been chosen as one of the top 5 featured posts at today’s party.

ReplyDeleteHave a great day!

Maria @ Krafty Cards etc.

http://kraftycardsetc.com/

Oh wow! Thank you so much!

Delete